Cardano Awaits Confirmation as Indicators Diverge

Cardano has been trading below $1 for a month, struggling to regain the momentum it had at the end of 2024. While ADA has shown signs of recovery, technical indicators remain mixed. BBTrend turned positive again but is still far from its previous highs.

The Ichimoku Cloud suggests an indecisive phase, where ADA is attempting to stabilize but lacks strong bullish confirmation. With key resistance at $0.83 and support at $0.65, its next move will be crucial in determining whether it can break out of its range or face further downside toward $0.50.

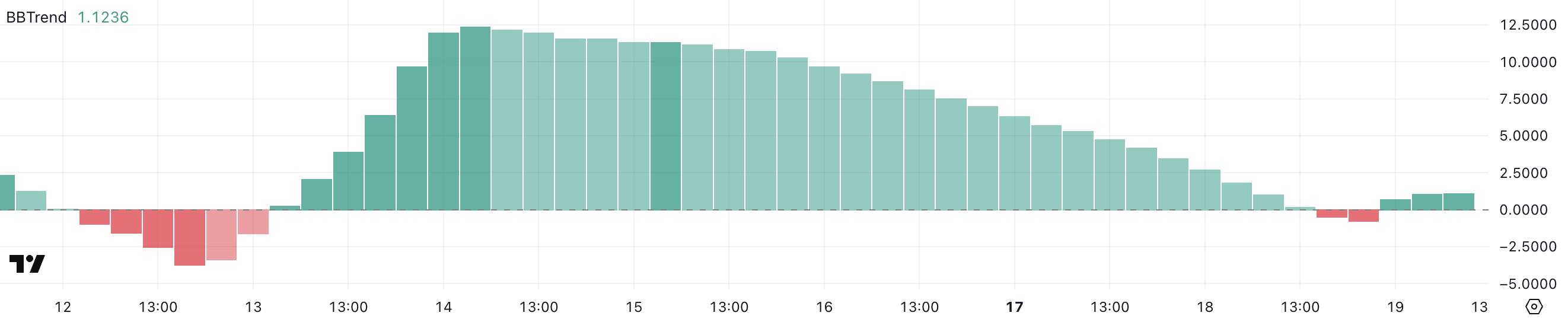

ADA BBTrend Is Back to Positive After Briefly Touching Negative Levels

Cardano’s BBTrend is currently at 1.12, recovering from a brief dip into negative territory at -0.77 yesterday. Between February 13 and February 18, BBTrend remained positive, peaking at 12.3 on February 14, indicating strong bullish momentum during that period.

However, the recent decline and subsequent rebound suggest that ADA has been experiencing increased volatility, with price action fluctuating between bullish and bearish phases.

While BBTrend is now back in positive territory, it remains far below its recent peak, signaling that ADA’s momentum has weakened but has not entirely shifted into a downtrend.

BBTrend, or Bollinger Band Trend, is an indicator that helps measure trend strength based on Bollinger Bands. It fluctuates between positive and negative values, with positive readings suggesting an uptrend and negative readings indicating bearish conditions.

ADA’s BBTrend at 1.12 suggests that the asset is holding onto a weak bullish structure but is lacking strong upside momentum. If BBTrend continues rising, it could confirm renewed buying pressure, supporting a sustained uptrend.

However, if it turns negative again, it would indicate that ADA is struggling to maintain upward momentum, increasing the risk of further consolidation or even a new downtrend.